The Influence of the IMF on Kenya's Financial Policies

Kenya's economic landscape is currently experiencing a significant and somewhat controversial shift, largely driven by the International Monetary Fund (IMF). The discourse around the IMF’s influence has reached new heights with the proposed Finance Bill 2024. Prominent Kenyan economists and industry leaders are raising their voices, expressing concerns regarding the long-term impacts of the IMF's stringent requirements.

Churchill Ogutu, an economist at IC Group, and Raimond Molenje, acting CEO of the Kenya Bankers Association (KBA), have brought to light the pressing implications of the bill. They argue that the IMF's policies historically pose risks that go beyond mere economic metrics, affecting social and economic stability in Kenya. Indeed, the financial narrative tethered to these policies finds echoes in the past struggles that have impeded the nation’s growth and caused social distress.

The IMF Programme and Structural Reforms

The current strain on Kenya’s economy is partially attributed to its commitment to the IMF Programme, slated from April 2021 to March 2025. This program is heavily oriented towards revenue-raising measures as a critical part of the country's structural reforms. Such measures primarily aim to decrease the budget deficit but have come at a significant cost.

This commitment involves a variety of stringent regulations, including a suite of tax increases. The proposed Finance Bill 2024 is a critical element of these reforms. It aims to boost government revenue but at the potential expense of the ordinary citizen's financial security and overall quality of life. The resulting increase in the cost of essential goods and services could be a burden that many Kenyans, already grappling with economic hardships, might find unbearable.

Impact on Cost of Living and Job Security

The broader economic and social impact caused by these policies cannot be understated. As costs rise, the ripple effects extend far and wide, affecting the average Kenyan's daily life. Essential goods and services, which form the backbone of everyday life, become more expensive. This in turn can adversely affect financial inclusion. People who were previously able to afford a decent living might find it increasingly difficult to make ends meet.

Churchill Ogutu points out that the negative impact on job security is palpable. Higher operational costs for businesses may lead to decreased hiring or, worse, layoffs. For a country with already high unemployment rates, this could exacerbate social unrest and economic inequality. Additionally, businesses confronted with high taxes could struggle to stay competitive, curtailing their ability to innovate and grow.

Lobbying Against Tax Measures

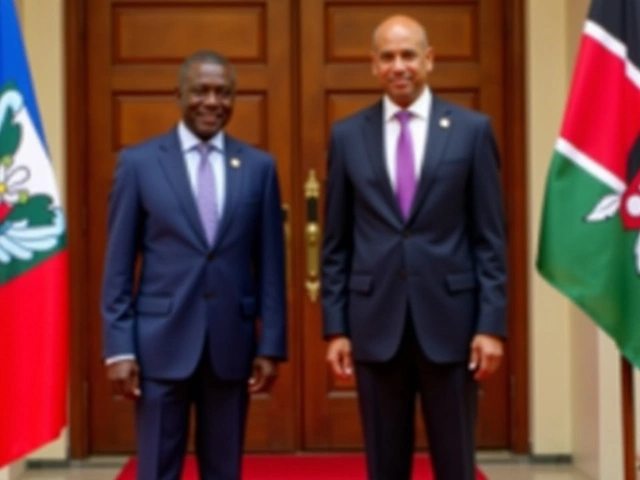

The reaction from various sectors against the proposed Finance Bill has been robust. Multiple industry stakeholders, including the Kenya Association of Manufacturers (KAM), have actively lobbied against the new tax measures. The KAM has even met with the IMF's Kenya Resident Representative, Selim Cakir, to discuss their concerns about the bill's provisions.

The concerns are not unfounded. Higher taxes can drive up production costs, which can in turn be passed on to consumers. This cascading effect leads to wider economic implications, triggering higher prices across the board. The controversial nature of these tax measures has drawn both domestic and international scrutiny, adding pressure on the Kenyan government and the IMF to carefully reconsider their approach.

Historical Context and Delay in Growth

The skepticism around IMF policies stems from a history riddled with mixed outcomes. Critics argue that the IMF's stringent policies have previously delayed Kenya’s economic growth. These policies often come with conditionalities that are challenging for developing economies to meet without incurring significant social cost.

Historically, IMF programs have involved cuts in public spending, which can translate into reduced funding for social services such as health and education. As a result, the long-term human capital development in the country suffers. This historical context provides a backdrop for the current discontent and skepticism surrounding the latest proposed reforms.

The Way Forward

Achieving economic reform without precipitating social distress remains a delicate balance. The concerns of economists, industry leaders, and other stakeholders underline the complexity of the challenge. They highlight the need for a nuanced approach that takes into account the broader social implications of economic policies.

Consultation, transparency, and a clear understanding of the ground realities are crucial in crafting policies that are not only effective but also equitable. The hope is that through continued dialogue and engagement with all stakeholders, a path forward can be forged that supports sustainable economic growth while protecting the welfare of the Kenyan people.

Final Thoughts

The IMF's involvement in Kenya's economic planning, particularly with the Finance Bill 2024, offers both opportunities and challenges. The road ahead requires thoughtful consideration of not just economic indicators but also the social fabric of the country. The ongoing debate highlights the importance of a balanced approach to economic policymaking, one that fosters growth while safeguarding the well-being of all citizens.

Joseph Prakash

June 13, 2024 AT 17:36Interesting how the IMF pressure keeps stacking tax hikes 😮 it feels like the everyday Kenyan will get squeezed harder and harder.

Arun 3D Creators

June 17, 2024 AT 06:53Behold the shackles of foreign dictate masquerading as fiscal prudence! Kenya's soul is bartered for a ledger of numbers! The Finance Bill becomes an altar where hope is sacrificed!

RAVINDRA HARBALA

June 20, 2024 AT 20:26The data speaks plainly – IMF-mandated tax hikes correlate with reduced private sector growth. Ignoring this trend is a folly no economist should entertain.

Vipul Kumar

June 24, 2024 AT 09:43Ravindra hits the nail on the head with those numbers. That said, we also need to remember the social safety nets that could mitigate the pain for households. A balanced approach that pairs fiscal consolidation with targeted subsidies might preserve jobs while keeping the deficit in check. Engaging community leaders in policy drafting could bridge the gap between macro‑targets and micro‑realities.

Priyanka Ambardar

June 27, 2024 AT 23:00Kenya should not be a puppet for an overseas institution – the IMF is just another form of neo‑colonialism 😤. Our own development path must be charted without foreign strings attached.

sujaya selalu jaya

July 1, 2024 AT 12:16While concerns about external influence are valid, collaboration can also bring technical expertise.

Ranveer Tyagi

July 5, 2024 AT 01:33Guys!!! This Finance Bill is a massive gamble!!! If the government pushes these taxes without proper cushioning, we’ll see a surge in unemployment!!! Businesses will either shut down or relocate!!! It’s critical to push for exemptions for SMEs and introduce progressive tax brackets!!!

Tejas Srivastava

July 8, 2024 AT 14:50Whoa!!! The drama is real!!! The ripple effect on everyday life could be catastrophic if not handled right!!! We need calm heads and solid data to cut through the hype!!!

JAYESH DHUMAK

July 12, 2024 AT 04:06The proposed Finance Bill 2024 represents a pivotal moment in Kenya's fiscal policy architecture. It seeks to augment revenue through a suite of tax adjustments, ostensibly to comply with IMF conditionalities. While revenue generation is a legitimate objective, the distributional impact of such measures warrants careful scrutiny. Historical precedents in other African economies suggest that abrupt tax hikes can exacerbate inequality and depress consumption. Moreover, the elasticity of demand for essential goods means that price increases may disproportionately affect low‑income households. The macro‑economic model underpinning the IMF program assumes that higher tax collection will translate into reduced deficits and lower borrowing costs. However, this assumption often overlooks the potential contractionary effect on private sector investment. Empirical studies from the past decade indicate a negative correlation between steep tax increments and private capital formation. In Kenya's context, the manufacturing sector, already grappling with global supply chain disruptions, could face heightened cost pressures. If firms are compelled to raise prices, the inflationary spiral could become self‑reinforcing. Additionally, the labor market may experience heightened volatility as businesses adjust their payrolls to manage rising operating expenses. The social safety nets currently in place are insufficient to absorb such shocks, risking a rise in poverty indices. A more nuanced approach could involve phased implementation of tax measures coupled with targeted subsidies for vulnerable groups. Engaging civil society, industry representatives, and academic experts in a transparent dialogue would enhance policy legitimacy. Ultimately, sustainable fiscal consolidation must balance fiscal prudence with social equity to ensure inclusive growth.

Santosh Sharma

July 15, 2024 AT 17:23Excellent breakdown! It captures the trade‑offs clearly and highlights the need for stakeholder engagement.

yatharth chandrakar

July 19, 2024 AT 06:40The interplay between fiscal policy and macro‑stability is complex. If the IMF framework is too rigid, it may limit Kenya's policy space. Adaptive mechanisms could allow adjustments based on real‑time economic indicators.

Vrushali Prabhu

July 22, 2024 AT 19:56Yatharth you rite on point but dont forget the “human factor” – people cant just alway adapt to sudden changes 😅. we need real solutions not just theories!!

parlan caem

July 26, 2024 AT 09:13The Finance Bill is nothing but a tax grab dressed up as reform.

Mayur Karanjkar

July 29, 2024 AT 22:30Such framing conflates fiscal consolidation with revenue extraction, overlooking structural adjustment nuances.

Sara Khan M

August 2, 2024 AT 11:46Sounds intense 😂

shubham ingale

August 6, 2024 AT 01:03We’ll get through this together 😊